All Categories

Featured

Table of Contents

There is no payment if the policy expires prior to your death or you live past the policy term. You may be able to renew a term plan at expiry, but the costs will certainly be recalculated based on your age at the time of renewal.

At age 50, the costs would certainly rise to $67 a month. Term Life Insurance Policy Rates thirty years old $18 $15 40 years of ages $28 $23 half a century old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in exceptional health. On the other hand, here's an appearance at prices for a $100,000 whole life plan (which is a kind of irreversible policy, suggesting it lasts your life time and consists of money worth).

10 Year Renewable Term Life Insurance

The minimized threat is one aspect that enables insurance providers to bill lower premiums. Interest prices, the financials of the insurance provider, and state guidelines can also influence costs. As a whole, companies commonly use far better prices at the "breakpoint" insurance coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you consider the amount of protection you can get for your costs bucks, term life insurance coverage often tends to be the least pricey life insurance policy.

Thirty-year-old George wishes to safeguard his household in the not likely occasion of his sudden death. He buys a 10-year, $500,000 term life insurance policy policy with a costs of $50 monthly. If George passes away within the 10-year term, the plan will certainly pay George's beneficiary $500,000. If he dies after the plan has actually expired, his recipient will obtain no advantage.

If George is identified with a terminal disease during the very first plan term, he most likely will not be eligible to renew the policy when it ends. Some policies supply assured re-insurability (without proof of insurability), yet such functions come with a higher cost. There are numerous kinds of term life insurance.

Most term life insurance coverage has a degree premium, and it's the type we have actually been referring to in most of this short article.

Level Premium Term Life Insurance Policies Xcel

Term life insurance policy is eye-catching to youngsters with children. Moms and dads can obtain substantial insurance coverage for an affordable, and if the insured dies while the plan holds, the family can depend on the survivor benefit to change lost revenue. These plans are also fit for people with growing family members.

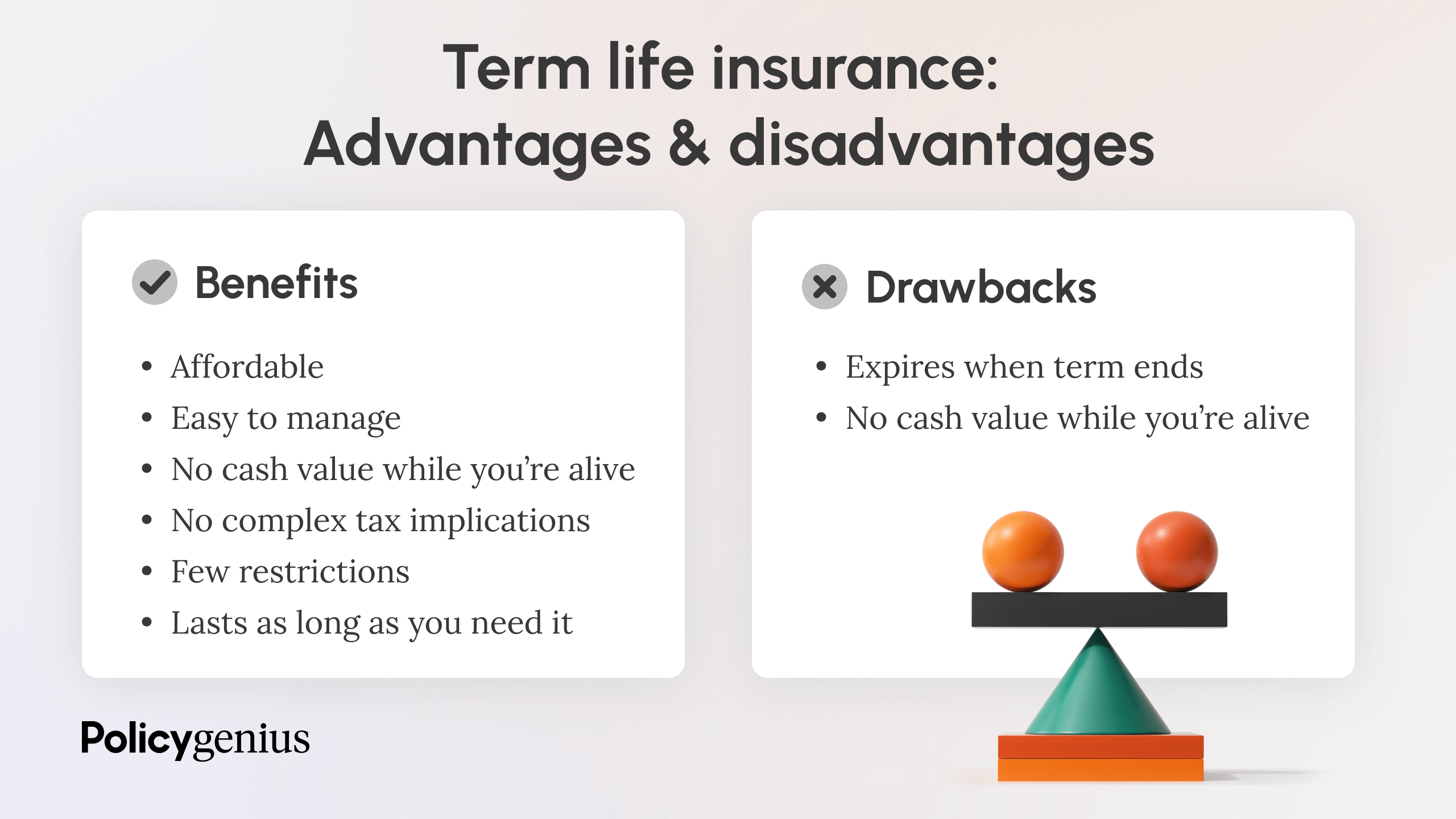

The best choice for you will certainly depend on your requirements. Right here are some points to consider. Term life policies are ideal for people who want substantial protection at an inexpensive. People that possess entire life insurance coverage pay a lot more in premiums for much less coverage but have the safety of understanding they are shielded for life.

The conversion cyclist ought to permit you to transform to any kind of permanent plan the insurance provider offers without restrictions - term life insurance scam. The key features of the cyclist are maintaining the initial health score of the term plan upon conversion (even if you later have health concerns or come to be uninsurable) and making a decision when and exactly how much of the coverage to convert

Certainly, total premiums will certainly enhance considerably considering that whole life insurance policy is extra pricey than term life insurance coverage. The advantage is the guaranteed authorization without a medical examination. Clinical conditions that develop during the term life period can not create premiums to be enhanced. The firm may call for restricted or full underwriting if you desire to add additional riders to the brand-new plan, such as a long-lasting care cyclist.

Whole life insurance coverage comes with substantially higher month-to-month costs. It is suggested to offer coverage for as long as you live.

Which Of The Following Statements Regarding Term Life Insurance Is Incorrect?

Insurance policy companies set a maximum age limit for term life insurance plans. The costs likewise rises with age, so an individual aged 60 or 70 will pay substantially more than a person decades more youthful.

Term life is somewhat comparable to car insurance policy. It's statistically not likely that you'll need it, and the premiums are cash away if you do not. If the worst occurs, your family will receive the benefits.

This plan design is for the customer who requires life insurance coverage yet would love to have the capacity to select just how their cash money worth is invested. Variable policies are underwritten by National Life and dispersed by Equity Solutions, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Business, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 award information, browse through Irreversible life insurance policy creates cash value that can be borrowed. Plan financings build up interest and overdue plan loans and interest will certainly reduce the death advantage and cash money value of the plan. The amount of money worth offered will typically depend upon the type of irreversible plan acquired, the quantity of insurance coverage purchased, the length of time the plan has been in pressure and any outstanding plan fundings.

Is 30-year Term Life Insurance Good

Disclosures This is a basic description of insurance coverage. A complete declaration of protection is found just in the policy. For more details on coverage, prices, limitations, and renewability, or to obtain protection, call your local State Ranch representative. Insurance plan and/or linked motorcyclists and functions may not be offered in all states, and policy conditions might differ by state.

The major differences between the various kinds of term life policies on the market involve the length of the term and the insurance coverage quantity they offer.Level term life insurance policy includes both level costs and a level death benefit, which indicates they stay the very same throughout the duration of the plan.

, also understood as a step-by-step term life insurance policy strategy, is a policy that comes with a fatality advantage that raises over time. Typical life insurance policy term lengths Term life insurance policy is inexpensive.

The primary differences between term life and whole life are: The length of your protection: Term life lasts for a set period of time and then ends. Average regular monthly entire life insurance rate is computed for non-smokers in a Preferred health and wellness classification, acquiring an entire life insurance policy paid up at age 100 supplied by Policygenius from MassMutual. Aflac offers numerous long-term life insurance policy policies, including entire life insurance, last expense insurance policy, and term life insurance coverage.

Latest Posts

Renewable Term Life Insurance Advantages

Can I Get Term Life Insurance If I Have Cancer

Burial Policy For Parent